Baji Live 999 - বাংলাদেশের লাইভ ক্রিকেট বেটিং সাইট 2025

বাজি লাইভ বাংলাদেশে ক্রিকেট বেটিং এবং লাইভ ক্যাসিনো খেলার জন্য আপনার বৃহত্তর জয় পেতে একমাত্র স্থান। ক্যুরাসাও গেমিং দ্বারা অফিসিয়ালি লাইসেন্সপ্রাপ্ত এবং সর্বোত্তম সুবিধাসমূহের সাথে প্রতিবেদন করা হয় যেন সমস্ত খেলোয়াড়ের প্রয়োজনীয়তা সম্পূর্ণভাবে পূরণ করা যায়। Baji Live 999 সবচেয়ে জনপ্রিয় অনলাইন ক্রিকেট বেটিং সাইট হিসাবে অভিবৃদ্ধি করতে সক্ষম, যেটি উন্নত প্রযুক্তিতে এন্ড্রয়েড/iOS মোবাইল ডিভাইস এবং উইন্ডোজ কম্পিউটার ডিভাইসে বিনামূল্যে অ্যাক্সেস করা যায়।

বাজি লাইভ আসছে রিয়েল টাইমের খেলাধুলা বেটিং এবং লাইভ ক্যাসিনো বেটিং যা প্রতিটি খেলোয়াড়ের দক্ষতা অনুযায়ী কাস্টমাইজ করা যেতে পারে। ভার্চুয়াল স্পোর্টস, বিভিন্ন বোনাস এবং আকর্ষণীয় প্রচারণা সহ সর্বাধিক লাভজনক প্রোমোশনের সঙ্গে লাইভ স্ট্রিমিং সহ ক্রিকেট বেটিং বিকল্প অনুষ্ঠিত করা হয় যা আপনার লগইন করার দ্রুত উদ্বেগ আকর্ষণ করে তা নিশ্চিত করতে যায়।

বাজি লাইভ সম্পর্কে সারসংক্ষেপ

| নাম | বাজি লাইভ |

|---|---|

| খেলা উপলব্ধ | ক্রিকেট, ফুটবল, কাবাড়ি, বাস্কেটবল, হর্স রেসিং, ভলিবল, বক্সিং, টেনিস, টেবিল টেনিস, এবং ই-স্পোর্টস। |

| বেট মার্কেট | ভারত, বাংলাদেশ |

| অড় | ক্রিকেট অড়, স্পোর্টস অড় |

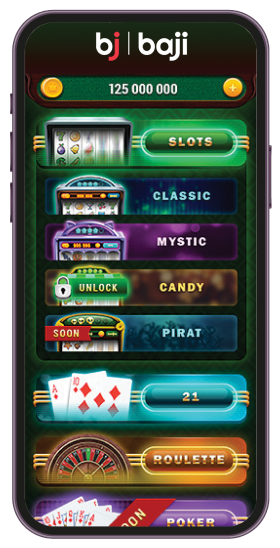

| ক্যাসিনো গেমস | লাইভ ক্যাসিনো গেমস, স্লট, ফিশিং গেমস, পোকার, রুলেট, ব্ল্যাকজ্যাক, বাকারাট, ইত্যাদি। |

| বোনাস | রেফারেল বোনাস, ক্যাশব্যাক, রিলোড বোনাস, ডিপোজিট বোনাস, ফ্রি বেট, রিফান্ড স্পোর্টস। |

| ব্যাংকিং পদ্ধতি | স্থানীয় ব্যাংক, বিকাশ, রকেট, ইউপে, ট্যাপ, ওকে ওয়ালেট, সিউয়ার ক্যাশ, নগদ, বিটকয়েন, ইউএসডিটি। |

| নূন্যতম বেট | ৫০০ বিডিটি |

| মোবাইল অ্যাপ | অ্যান্ড্রয়েড, আইওএস |

| লাইসেন্স | গেমিং কুরাকাও |

| ভাষা | ইংরেজি, বাংলা, হিন্দি |

কেন আপনার বাজি লাইভ 999 নির্বাচন করতে হবে

আপনারা অবশ্যই বুঝতে হবে যে বাজি লাইভ 999 খেলোয়ারদের মধ্যে সেরা, আকর্ষণীয় এবং লাভজনক সেবা বিকল্প সরবরাহ করে, যেটি অনলাইনে কোনও ক্যাসিনো গেম প্রয়োজন পূরণ করে। এখানে তিনটি সেরা বৈশিষ্ট্য রয়েছে, যেমন:

বাজি লাইভ নিরাপদ এবং প্রতিষ্ঠিত হয়েছে

বাজি লাইভ স্পোর্টস বেটিং

বাজি লাইভ একটি জনপ্রিয় খেলা বেটিং গেমিং সমাধান প্রদান করে যেখানে প্রতিটি খেলোয়াড়ের পছন্দসই খেলা এবং দক্ষতার অনুযায়ী বিভিন্ন অপশন রয়েছে যেমন ক্রিকেট, কাবাড়ি, ফুটবল, টেনিস, বাস্কেটবল, ভলিবল, হ্যান্ডবল, এমএমএ, ফিফা, টেবিল টেনিস এবং অনেক অন্যান্য। এই খেলা বেটিং আসছে অনন্য বৈশিষ্ট্য এবং বেটিং অপশন সহ, যেমন মোট গোলের সংখ্যা, কোন দল প্রথম গোল স্কোর করবে, কোন দল সবচেয়ে বেশি গোল স্কোর করবে, এবং অনেক অন্যান্য বেটিং অপশন।

বাজি লাইভ মোবাইল অ্যাপ্লিকেশন

বাজি লাইভ বাংলাদেশ একটি অনলাইন ক্রিকেট বেটিং এবং ক্যাসিনো গেমস ওয়েবসাইট যা গুগল এবং অ্যাপলের বিরুদ্ধে অনলাইন জুয়ার উত্সের সীমাবদ্ধ নীতিগুলির ভিত্তিতে এন্ড্রয়েড এবং iOS মোবাইল ডিভাইসের মাধ্যমে উন্নত প্রযুক্তির অ্যাক্সেস প্রদান করে। তাই বাজি লাইভ আধিকারিক ওয়েবসাইট পৃষ্ঠায় এন্ড্রয়েড এবং iOS ডিভাইসে ডাউনলোড করার জন্য আপনাকে গাইড করার জন্য কয়েকটি পদক্ষেপ সরবরাহ করে।

বাজি লাইভ 999 এ জনপ্রিয় খেলা বেটিং গেমস।

ক্রিকেট বেটিং

বাজি লাইভ 999 এবং BetVisa – এ ক্রিকেট বেটিং বাংলাদেশে সবচেয়ে জনপ্রিয় খেলা বেটিং মধ্যে একটি, যেখানে উচ্চ দক্ষতা অর্জনের জন্য আগ্রহজনক ম্যাচ সরবরাহ করে। ক্রিকেট বেট করার জন্য দক্ষতা বৃদ্ধি করতে, খেলার পদ্ধতি, দল নির্বাচনের মানদণ্ড, উপলব্ধ বেট প্রকার এবং অন্যান্য অংশগুলি অন্তর্ভুক্ত করা হয়।

কাবাডি বেটিং

কাবাডি বেটিং বাজি লাইভ বাংলাদেশে ক্ষমতার সঙ্গে বাজি জিতার অবসর প্রদান করতে পারে যেখানে বৈশিষ্ট্য এবং গেম দক্ষতা উন্নত করার সুযোগ হিসাবে আপনার বিজয়ী বেটের ভাগ্য প্রদান করে।

টেনিস বেটিং

টেনিস বেটিং বিভিন্ন প্রকারের বেট সরবরাহ করে, যেমন ম্যাচের বিজয়ীর উপর বেট, সেট বিজয়ীর উপর বেট, টুর্নামেন্ট বিজয়ীর উপর বেট, এবং অন্যান্য। ম্যাচের সময়ে লাইভ বেটিং যেগুলি গেম্বলারদেরকে রিয়েল-টাইমে তাদের বেট রাখতে অনুমতি দেয়।

ঘোড়া দৌড় বেটিং।

বাজি লাইভ খেলোয়ারদের মধ্যে সবচেয়ে জনপ্রিয় ঘোড়া দৌড় বেটিং হিসাবে পরিচিত, যেখানে উত্তেজনা এবং অনিশ্চিত ফলাফল অফার করে। আপনি যদি একজন অভিজ্ঞ জুয়ার বা একজন নতুন যাত্রী হন যিনি এই বেট একটি চেষ্টা দেওয়া চায়, তবে আপনার পছন্দের ঘোড়াগুলিতে বেট দিতে বাজি লাইভ ক্যাসিনোতে ঘোড়া দৌড় বেটিং শুরু করার জন্য প্রস্তুত থাকুন। দায়িত্বশীলভাবে জুয়া খেলা এবং লাভ নিন।

ফুটবল বেটিং

বাজি লাইভ বাংলাদেশে সবচেয়ে জনপ্রিয় খেলা বেটিং হিসাবে, ফুটবল একটি বেট যা সম্ভাব্য ম্যাচের পূর্ণ নম্বর গোল, কোন দল প্রথমে গোল করবে, এবং কোন দল সবচেয়ে বেশি গোল করবে ইত্যাদির মধ্যে বেশ কিছু ম্যাচ প্রেডিকশন দিয়ে খেলা হয়।

ভার্চুয়াল বেটিং।

ওয়েজ লাইভ ভার্চুয়াল বেটিং হল একটি অবিরত ম্যাচ ঘটনার ধারাবাহিকতা যাতে সর্বদা বেট করার জন্য কিছু থাকে। প্রথমিক খেলার বেটিংর বিপরীতে, যেখানে পরবর্তী ম্যাচের অপেক্ষা করতে হয়, ভার্চুয়াল স্পোর্টস একটি অবিরত এবং দ্রুত বেটিং অভিজ্ঞতা সরবরাহ করে।

বাজি লাইভ ক্যাসিনোতে উপলব্ধ ক্যাসিনো গেমস।

বাংলাদেশে এক্সাইটিং, দ্রুতগতিতে এবং সহজে খেলা নির্বাচন করা একটি বৃহত্তর পরিসরে, বাজি লাইভ অনলাইন ক্যাসিনো গেমসে আপনার হাতে পেতে পারেন।

বাজি লাইভ স্লটস।

বাজি লাইভ ক্যাসিনো বিভিন্ন ধরনের স্লট গেম সরবরাহ করে, প্রতিটি একটি অনন্য বৈশিষ্ট্য এবং গেমপ্লে সহ। বিভিন্ন ধরনের স্লট গেম সম্পর্কে জানা আপনাকে আপনার পছন্দ অনুযায়ী সেরা টি চয়ন করতে সাহায্য করবে। বাজি লাইভ স্লটস এক্সাইটিং অভিজ্ঞতা এবং গেমস উপভোগ করার সহজ ইন্টারফেস এবং আকর্ষণীয় গ্রাফিক্স দিয়ে আপনাকে সম্পূর্ণ নতুন অভিজ্ঞতা দেয়। ওয়েজ লাইভ স্লটস একটি সমস্তক্ষেত্রে গেমিং অভিজ্ঞতা এবং স্ট্রিমিং বৈশিষ্ট্য সহ সুস্থ, দৃশ্যময় আকর্ষণীয় গেমিং অভিজ্ঞতা নিশ্চিত করে। লাইভ গেম সুযোগ সরবরাহ করা, ইন্টারেক্টিভ এবং রোমাঞ্চকর বেটিং আব atmosphereফির প্রস্তুত করা হয়। সহযোগী গেমার এবং দক্ষ ডিলারদের সাথে অংশগ্রহণের সুযোগ গেমিং অভিজ্ঞতাকে একটি নতুন মাত্রা দেয়, যা এটির ব্যাপারে আরও বাস্তবায়ন এবং আনন্দময় মনে হয়।

বাজি লাইভ লাইভ ক্যাসিনো গেমস।

গোপনীয়তা নীতি প্রবেশদ্বার মাধ্যমে খেলোয়ারদেরকে তাদের স্বপ্নসমূহ সত্য করতে অনুমতি দেয়, যেখানে পরিকল্পনামূলক এন্ড্রয়েড এবং iOS মোবাইল অ্যাক্সেসের মাধ্যমে অভিজ্ঞ খেলোয়ারদের বা নতুন খেলোয়ারদের জন্য একটি অস্ত্রোপচায়িত এবং অনন্য গেমিং অভিজ্ঞতা নিশ্চিত করার জন্য, অনলাইন লাইভ ক্যাসিনো গেমসের পছন্দ পারফেক্ট। বাজি লাইভ লটারি বাজি লাইভ ক্যাসিনোতে সবচেয়ে জনপ্রিয় খেলা লটারি, একটি খেলা নিম্নলিখিত মেয়াদে ভাগ্যের উপর নির্ভর করে। এই খেলাগুলি উন্নত প্রযুক্তি এবং কঠোর গোপনীয়তা নীতি দ্বারা নিরাপত্তা এবং সুরক্ষা নিশ্চিত করে, তাই আপনি সর্বদা আপনার ব্যক্তিগত এবং আর্থিক তথ্য সুরক্ষিত রাখতে পারেন।

বাজি লাইভ ফিশিং গেমস।

বাজি লাইভ ফিশিং গেমস একটি নতুনত্বপূর্ণ এবং ইন্টারেক্টিভ উপায়ে শুটিং, স্ট্র্যাটেজি এবং গেমপ্লে উপাদানগুলি সংযুক্ত করা। এই খেলা অভিজ্ঞ খেলোয়ারদের সাথে নবীন খেলোয়ারদের মধ্যে প্রমুখ খেলা হিসাবে গুনি মাছ শুট করতে। আপনি একটি জীবনপূর্ণ সমুদ্র প্রদেশে অবস্থিত মহাসাগরিক ভাববেন। এই খেলাটি খেলোয়ারদেরকে বিভিন্ন ধরনের মাছের সম্মুখীন করবে, যাতে ছোট এবং দ্রুত থেকে বৃহত এবং অনুমিত পর্যন্ত বিভিন্ন প্রজাতির মাছ সম্মিলিত থাকে।

বাজি লাইভ আর্কেড গেমস।

বাজি লাইভ আর্কেড গেমস প্রশংসা পায় ব্যাপক জাতির ভিত্তিতে বিভিন্ন আকারের গেমস, যেমন, অ্যাকশন, পাজল, রেসিং এবং অন্যান্য। বাজি লাইভের ব্যবহারকারী বন্ধুত্বপূর্ণ ইন্টারফেস এবং গেমপ্লে নিশ্চিত করে যে খেলোয়াররা দক্ষতা, পরিকল্পনা এবং উত্তেজনার সমানুপাতিক সমন্বয়ে উপভোগ করতে পারে। বাজি লাইভ আর্কেড আপনাকে উত্সাহমূলক, মস্তিষ্ক-বিক্ষোভক পাজল বা রেস, যেটি আপনার এড্রেনালিন পাম্প করে।

বাজি লাইভ টেবিল গেমস।

বাজি লাইভ টেবিল গেমস স্ট্রিমিং প্রযুক্তি সহ লাইভ ডিলারদের সঙ্গে প্রদান করে যাতে খেলার নিবেদিতা রিয়েলিস্টিক এবং ন্যায্য হয়। বাজি লাইভ টেবিল গেমস খেলা হতে পারে একটি কফি সঙ্গে বেটে যাওয়া অভিজ্ঞতা, যা আপনাকে একটি চমকপ্রদ দৃশ্যমান ইন্টারফেসের সাথে স্বাগত করে যা আপনাকে তা অনুভব করে নিতে অবিলম্বে একটি ধনী ক্যাসিনোর মজার বাতাসে নিয়ে যায়।

বাজি লাইভ বাংলাদেশের সেরা ক্যাসিনো গেম সরবরাহকারীগুলি।

ক্রিকেট এক্সচেঞ্জ (সিআরইএক্স)।

ক্রিকেট এক্সচেঞ্জ বাজি লাইভ বাংলাদেশের সেরা সরবরাহকারী, যারা নতুনত্বপূর্ণ প্রস্তাব সঙ্গে ক্রিকেট খেলা তৈরি করেন এবং বাজি লাইভ ৯৯৯তে সান্নিধ্যভুক্ত করে স্বচ্ছ এবং ব্যাপক ক্রিকেট বেটিং অভিজ্ঞতা প্রদান করে।

জিলি গেমিং।

এভোলিউশন গেমিং

প্রধান প্রদানকারী হিসেবে, Jili Gaming অপ্রাসঙ্গিক লাইভ ক্যাসিনো গেমিং অভিজ্ঞতা সমাধান সরবরাহ করে যা লাইভ ডিলারদের সাথে সংযুক্ত হওয়ার অভিজ্ঞতা সরবরাহ করতে সক্ষম এবং আপনার নিজের ঘরের সুবিধায় আসল ক্যাসিনো ভাতায় একটি আসল ক্যাসিনো ভাতায় আনন্দ অনুভব করা।

পি.জি সফট

প্রধান প্রদানকারী পিজি সফট ব্যবহার করে নতুনত্তম HTML5 প্রযুক্তি যার মাধ্যমে এক্সেস অত্যন্ত দ্রুত হয় Android এবং iOS মোবাইল ডিভাইসের মাধ্যমে বিভিন্ন ধরণের ক্যাসিনো গেম অন্তর্ভুক্ত স্লট, টেবিল গেম, এবং লাইভ ডিলারের সাথে গেম। Baji Live বাংলাদেশে PG Soft এর অনলাইন ক্যাসিনো গেমগুলি অবলম্বন করুন যেমন The Trillionaire, Summon and Conquer, এবং Medusa II: The Quest of Perseus, যেগুলির প্রতিটি সুন্দর গ্রাফিক্স, উত্তেজনাদায়ক গেমপ্লে এবং প্রযুক্তিগত বোনাস ফিচার অন্তর্ভুক্ত রয়েছে।

বাজি লাইভ বাংলাদেশে কিভাবে নিবন্ধন করবেন?

ধাপ ১: বাজি লাইভ বাংলাদেশের অফিসিয়াল ওয়েবসাইটে যেতে হবে।

এটা আপনার পছন্দের ওয়েব ব্রাউজার খুলে ওয়েবসাইটের মুখোমুখি নিবন্ধনের ক্ষেত্রে ক্লিক করুন এবং নিবন্ধনের প্রক্রিয়ার সমস্ত শর্তাবলী অনুসরণ করুন। নিবন্ধন ফর্ম পূরণ করা

ধাপ ২: নিবন্ধন ফর্ম পূরণ

নিবন্ধন ফর্মে আপনার নাম, ইমেল ঠিকানা, ফোন নম্বর, এবং পাসওয়ার্ড প্রয়োজনীয় তথ্যের ফিল্ডগুলিতে সমস্ত তথ্য পূরণ করুন আপনার ডেটা গোপনীয়তার অনুযায়ী। পুনঃনতুন পড়া এবং শর্তাবলী অনুমোদন করার আগে নিশ্চিত হন। শর্তাবলী বুঝে গেলে, আপনি পরবর্তী পদক্ষেপে অগ্রসর হতে সম্মতি দিতে পারেন।

ধাপ ৩: আপনার অ্যাকাউন্ট যাচাই করুন

আপনাকে কিছু সময় অপেক্ষা করতে হবে ফর্মটি যাচাই করার জন্য। আপনার ডেটা তথ্য যদি বৈধ হয় তবে বাজি লাইভ আপনাকে যাচাইকরণ ইমেল পাঠিয়ে দেবে, এটি বাজি লাইভে যোগদান এবং আপনি বাজি লাইভে একটি অ্যাকাউন্ট অর্জন করেছেন এটির প্রমাণ।

ধাপ ৪: আপনার অ্যাকাউন্টে লগইন করুন

আপনার অ্যাকাউন্ট যখন যাচাই করা হবে, তখন আপনি আপনার ইমেল ঠিকানা, ফোন নম্বর এবং পাসওয়ার্ড ব্যবহার করে আপনার বাজি লাইভ অ্যাকাউন্টে লগ ইন করতে পারবেন। বাজি লাইভ বাংলাদেশে উপভোগ করুন উত্তেজনাদায়ক এবং লাভজনক অনলাইন ক্যাসিনো গেম সিলেক্ট করে।

বাংলাদেশে জনপ্রিয় বাজি লাইভ বোনাস এবং প্রচারাভারনা।

আপনার জিতের সুযোগ বাড়ানোর সাথে সাথে, বাজি লাইভ বিভিন্ন প্রচারাভারনা এবং বোনাস দেয়।

স্লট এবং ফিশিং এ 100% বোনাস, সর্বোচ্চ ১,৭৭৭ টাকা পর্যন্ত।

বাংলাদেশের বাজি লাইভে ১০০% এর একটি আকর্ষনীয় বোনাস হিসাবে স্পেশালাইজড স্লট এবং ফিশিং গেমগুলির জন্য। খেলোয়াড়রা তাদের জিতের সুযোগ বাড়ানোর একটি অসাধারণ সুযোগ হিসাবে ১,৭৭৭ টাকা পর্যন্ত বোনাস পেতে পারেন এবং এই খেলার আনন্দ উপভোগ করতে পারেন।

৫০% স্পোর্টস রিফান্ড, সর্বোচ্চ ১,০০০ টাকা পর্যন্ত।

বাজি লাইভ স্পোর্টস বেটিং রিফান্ড বোনাস প্রদান করে ৫০% এর সাথে, খেলোয়াড়দের তাদের হার থেকে সর্বোচ্চ ১,০০০ টাকা প্রাপ্ত করতে। এই বোনাস একটি সুরক্ষা নেট হিসেবে কাজ করে এবং নিশ্চিত করে যে ব্যবহারকারীরা তাদের হারের চিন্তা করা ছাড়াই তাদের বেটিং অভিজ্ঞতা উপভোগ করতে পারেন।

প্রতিদিন অতিরিক্ত ১.৫% আদায় বোনাস।

বাজি লাইভ আপনার চাহিদাগুলির যত্ন নেয় এবং সমস্ত প্লেয়ার ডিপোজিটে প্রতিদিন অতিরিক্ত ১.৫% আদায় বোনাস প্রদান করে। এটি আপনার অ্যাকাউন্ট ব্যালেন্স বৃদ্ধি করার এবং বাজি লাইভ বাংলাদেশে আপনার প্রিয় ক্রিকেট বেটগুলির উপর বড় জিতের সুযোগ বাড়ানোর এক অসাধারণ উপায়।

বাজি লাইভ রেফারেল বোনাস।

বাজি লাইভ খেলোয়াড়দের জন্য একটি রেফারেল বোনাস প্রদান করে যাতে তারা প্রতিটি বন্ধুকে রেফার করে তাদের বাজি লাইভে একটি অ্যাকাউন্ট সফলভাবে যোগ দিতে পারেন। যতবেশি বন্ধু আপনি রেফার করবেন, ততবেশি বোনাস আপনি অর্জন করতে পারেন। এই বোনাসটি আপনার এবং আপনার বন্ধুদের জন্য একটি জয়কারী সুযোগ করে।

বাজি লাইভ অ্যাপটি APK ফরম্যাটে ডাউনলোড করতে কীভাবে হয়

বাংলাদেশে বাজি লাইভ অ্যান্ড্রয়েড এবং iOS ডিভাইসের জন্য একটি ডেডিকেটেড মোবাইল অ্যাপের মাধ্যমে প্রযুক্তিগতভাবে উন্নত অ্যাক্সেসের বিকল্প অফার করে। কিভাবে বাজি লাইভ অ্যাপ ডাউনলোড করতে হয় তা বুঝতে আপনার জন্য আরও সহজ করতে নিচের ধাপগুলি অনুসরণ করুন:

- আপনার Android এবং iOS Apk মোবাইল সেটিংসে ‘অজানা উৎস’ সক্রিয় করতে হবে।

- আপনার মোবাইল ব্রাউজার খুলে বাজি লাইভ ওয়েবসাইটে যান এবং সরাসরি Baji Live APK ফাইলের ডাউনলোড লিঙ্ক সহ Android এবং iOS APK ফাইলটি ডাউনলোড করুন।

- ডাউনলোড প্রক্রিয়া সম্পন্ন হলে APK ইনস্টল করুন, আপনার ডিভাইসের ডাউনলোড ফোল্ডারে এই APK ফাইলটি খুঁজে বের করুন, তারপর ইনস্টলেশন প্রক্রিয়া শুরু করতে স্ক্রিনের নির্দেশানুসারে অনুসরণ করুন।

- ইনস্টলেশন সম্পন্ন হলে লগইন করুন এবং ইনস্টলেশন সম্পন্ন হলে বেটিং শুরু করুন, তারাতারি আপনার Android ডিভাইসে বাজি লাইভ 999 অ্যাপ খোললে, আপনি আপনার অ্যাকাউন্টে প্রবেশ করতে পারবেন এবং বাজি লাইভ বাংলাদেশের সবচেয়ে ভাল সুবিধাগুলি উপভোগ করতে শুরু করতে পারবেন যেমন রোমাঞ্চক অনলাইন ক্রিকেট বেটিং।

বাজি লাইভ এফিলিয়েট প্রোগ্রামে যোগদান করুন, প্রাপ্ত করুন সর্বোচ্চ ৫০% কমিশন!

বাজি লাইভ এফিলিয়েট প্রোগ্রাম আপনার প্রভাব ব্যবহার করে অন্যান্য খেলোয়াড়কে রেজিস্টার এবং লগইন একটি বাজি লাইভ অ্যাকাউন্টে আকর্ষিত করার সুযোগ প্রদান করে। খেলোয়াড়দের অধিক লাভ উপার্জনের সুযোগ নেওয়ার সুযোগ নিন বাজি লাইভ অ্যাফিলিয়েট হওয়ার জন্য। আপনার কাজ শুধুমাত্র ভবিষ্যতের খেলোয়াড়দের মধ্যে সেতু গড়ে তোলা এবং তাদেরকে প্রতিষ্ঠানের সব সুবিধা এবং সেবা সর্বোত্তম যা লাভ বৃদ্ধি করতে এবং বাস্তব জয়ের সুযোগ প্রদান করতে বাজি লাইভে বিশ্বাসী। আপনার বাজি লাইভ বাংলাদেশের বৃদ্ধির জন্য ডাকা মার্কেটিং প্রক্রিয়া মূলত লাভের উৎস দ্বারা মূল্যায়ন করা হয়। বাজি লাইভ বাংলাদেশে লাভ প্রদানের জন্য গম্যতায় প্রতিশ্রুতি দেওয়া হয়, আপনার সাহিত্যে প্রচারণা সংক্রিয় করার মাধ্যমে প্রচারিত অফারগুলি সংযুক্ত করা হয়। আপনি যখন সামাজিক মাধ্যম, ইমেল বা অন্যান্য মাধ্যমে আপনার পাঠকগণের সাথে পরিচয় করার জন্য আপনার অ্যাফিলিয়েট লিঙ্কগুলি শেয়ার করার সৃষ্টিশীল উপায় পাবেন এবং বাজি লাইভের গেম এবং বেটিং বিকল্পগুলির প্রচার করার সৃষ্টিশীল উপায় পাবেন।”

অফিসিয়াল বাজি লাইভ ব্রান্ড এম্বাসেডর

এমন আমি জ্যাকসন, হানসিকা মতওয়ানী, এবং গাব্রিয়েল বাটিস্টুটা ব্র্যান্ড এম্বাসেডর হিসেবে নিয়োজিত করে বাজি লাইভ বাংলাদেশ অনলাইন ক্রিকেট এবং লাইভ ক্যাসিনো বেটিং সাইটগুলির মধ্যে অন্যতম একটি হয়ে উঠল। আমরা এই প্রসিদ্ধ ব্যক্তিদের সাথে সহযোগিতা করার জন্য অত্যন্ত গর্বিত। ব্র্যান্ড এম্বাসেডররা বাজি লাইভ বাংলাদেশের মান এবং আদর্শগুলি প্রচার করতে গুরুত্বপূর্ণ ভূমিকা রয়েছেন যাতে বাজি লাইভ ওয়েবসাইটের ব্র্যান্ড উপস্থিতি প্রবর্ধন করে। প্রতিবছরে, বাজি লাইভ বাংলাদেশ এর ব্র্যান্ড চিহ্ন প্রচারের বিভিন্ন উদ্যোগ এবং ঘটনায় বাজি লাইভ কথা বলার সহযোগী ব্যক্তিদের নির্বাচন চালিয়ে যাচ্ছে। 2025 সালের অফিসিয়াল ব্র্যান্ড এম্বাসেডরের ঘোষণার জন্য আহ্বানের সময়ে আশা নির্ধারিত হয়েছে, বাজি লাইভ তাদের অনুগ্রহ করে 2025 সালের ব্র্যান্ড এম্বাসেডর কে হবে সে সম্পর্কে তাদের অনুমান এবং শোনা স্পষ্ট করে নিয়মিত অবলম্বন করে।

বাজি লাইভ ক্যাসিনোর লাইসেন্স এবং সুরক্ষা

বাজি লাইভ বাংলাদেশ সরকার কর্যালয়ের অনুমোদিত কুরাকাও গেমিং দ্বারা সরকারের অনুমোদিত এক ব্যাপক জনপ্রিয় খেলার বেটিং এবং লাইভ ক্যাসিনো গেম উপলব্ধ করার জন্য সময়মত্ত এবং স্বচ্ছতাপূর্ণ এবং দায়িত্বশীল ভাবে। এটি স্থানীয় সরকারের অনুমোদিত দেশগুলিতে অনলাইন খেলার বেটিং এবং গেমব্লিং উপলব্ধ করার সম্ভাবনা করে। বাজি লাইভ অনুমোদিত লাইসেন্স সম্পর্কের দেশের তালিকা চেক করার সুযোগ দেওয়া হয়, যাতে আপনি বাজি লাইভ বাংলাদেশের অফিসিয়াল ওয়েবসাইটে কোনও বাধায় ছাড়াই যেতে পারেন।

বাজি লাইভ বাংলাদেশের জনপ্রিয় ব্যাংকিং পদ্ধতিগুলি

আপনাকে বাজি লাইভ বাংলাদেশে ক্রিকেট বেটিং এবং লাইভ ক্যাসিনো খেলার জন্য চিন্তা করতে হবে না কারণ এখানে বিভিন্ন অর্থ পরিশোধের পদ্ধতির সেবা সুবিধা রয়েছে, যেমন নিম্নলিখিত ব্যাংকিং পদ্ধতিগুলি:

স্থানীয় ব্যাংকিং

একটি বাজি লাইভের অর্থ প্রদানের পদ্ধতির হিসাবে, যা স্থানীয় ব্যাংকিং পদ্ধতিসমূহ সমর্থন করে, বাংলাদেশী খেলোয়াড়দের জন্য অর্থ জমা ও উত্তোলন করা সহজ করে।

বিকাশ

বিকাশ বাংলাদেশে বাজি লাইভে একটি অর্থ প্রদানের পদ্ধতি, যা প্রচলিত মোবাইল ব্যাংকিং আর্থিক সেবা ব্যবহার করে, এটি বাজি লাইভ প্ল্যাটফর্মে অর্থ জমা এবং উত্তোলনের জন্য উপলব্ধ। এতে সমস্ত অর্থ প্রদান এবং উত্তোলন লেনদেনগুলি কিছু মিনিটের মধ্যে পূর্ণ হতে পারে।

ওকেওয়ালেট

ওকেওয়ালেট একটি আর্থিক লেনদেনের পদ্ধতির বাজি লাইভ বাংলাদেশে, যা বাজি লাইভ অ্যাপ দ্বারা নিরাপদভাবে গ্রহণ করা হয়, খেলোয়াড়দের জন্য সমস্যারহিত লেনদেন সক্ষম করে।

বাজি লাইভ বিডিটির বিভিন্ন গ্রাহক সমর্থন চ্যানেল।

বাজি লাইভ বাংলাদেশ, যা বাংলাদেশে সবচেয়ে জনপ্রিয় ক্রিকেট বেটিং সরবরাহ করে, বাজি লাইভ অ্যাকাউন্ট ব্যবহার করার সময় সমস্যা এবং অসুবিধা হলে তাদের সঙ্গে সরাসরি যোগাযোগ করতে নিম্নলিখিত বিকল্প বিকল্প রয়েছে:

লাইভ চ্যাট

লাইভ চ্যাট সাথে যোগাযোগ করার একটি লেনদেন বিকল্প, যা ২৪/৭ বাজি লাইভ বাংলাদেশের পেশাদার গ্রাহক সমর্থন সেবা দলের সাথে সরাসরি যোগাযোগ করার জন্য। বাজি লাইভের পেশাদার দল আপনার সমস্যার সাথে সরাসরি প্রতিক্রিয়া দেয় এবং সেরা সমাধান দেয়।

টেলিগ্রাম

এটি একটি পছন্দনীয় পদ্ধতি যেখানে বাজি লাইভ খেলোয়াড়রা যদি তারা টেলিগ্রাম অ্যাপ্লিকেশনের মধ্যে যোগাযোগ নম্বরের মাধ্যমে সরাসরি চ্যাট করতে চান যা নম্বর: +880 115 845 4385 সাথে সংযুক্ত আছে।

সোশ্যাল মিডিয়া

বাজি লাইভ বাংলাদেশের গ্রাহক সেবা সমর্থনের একটি পদ্ধতি যা আপনাকে ফেসবুক এবং ইনস্টাগ্রাম সহ সোশ্যাল মিডিয়ার মাধ্যমে বাজি লাইভ সম্পর্কে যেকোনো তথ্য পেতে সুযোগ দেয়। বাজি লাইভ সমস্ত আপনার প্রশ্ন ও চিন্তা সময়ে এবং দক্ষতাপূর্ণভাবে সমাধান করবে। যদি আপনি ক্রিকেট বেটিং মার্কেট এবং লাইভ ক্যাসিনো গেমস সম্পর্কে স্পষ্টতা চান, তবে এই সেবায় সরাসরি যোগাযোগ করুন।

ইমেল

আপনি ইমেলের মাধ্যমে আমাদের সাথে যোগাযোগ করতে পারেন। আমাদের সমর্থন দলের জন্য একটি বাক্য লিখুন support.bd@bajilive.app ঠিকানায় একটি বার্তা পাঠান এবং আমরা সম্ভাব্যতঃ সর্বশেষ সময়ে আপনার অনুরোধের প্রতিক্রিয়া দেব।

সচরাচর জিজ্ঞাসা

বাজি লাইভ কি?

বাজি লাইভ সর্বাধিক জনপ্রিয় অনলাইন ক্রিকেট বেটিং সাইট যা উন্নত প্রযুক্তির মাধ্যমে এডভান্সড টেকনোলজির মাধ্যমে অ্যান্ড্রয়েড/আইওএস মোবাইল ডিভাইস এবং উইন্ডোজ কম্পিউটার ডিভাইসে মুফতে সহজলভ্য ক্রিকেট খেলার অভিজ্ঞতা বাড়াতে সক্ষম। বাজি লাইভ প্রতিটি খেলোয়াড়ের দক্ষতা সেটের উপর ভিত্তি করে কাস্টমাইজ করা হয় একসময়িক স্পোর্টস বেটিং এবং লাইভ ক্যাসিনো বেটিং সরবরাহ করে। এটি বাস্তবায়নে একাধিক আকর্ষণীয় বোনাস এবং প্রচারণা সহ বিভিন্ন ক্রিকেট বেটিং বিকল্পগুলির সাথে সময় সময়ে বিশেষভাবে প্রদর্শিত হয়।

বাজি লাইভ নিরাপদ এবং নিরাপদ কি?

একটি বিখ্যাত সাইট হিসাবে, বাজি লাইভ বাংলাদেশ অফিসিয়ালি কুরাকাও গেমিং দ্বারা সরকারের অনুমোদিত এক ব্যাপক জনপ্রিয় খেলার বেটিং এবং লাইভ ক্যাসিনো গেম সরবরাহ করার জন্য অনুমোদিত হয়। এটি স্থানীয় সরকার দ্বারা অনুমোদিত দেশগুলিতে অনলাইন ক্রিকেট বেটিং এবং গেমব্লিং সরবরাহ করার সম্ভাবনা তৈরি করে।

বাজি লাইভে বাট কীভাবে রাখবেন?

আপনি যদি বাজি লাইভ বাংলাদেশে একটি বেট রাখতে চান তবে অবশ্যই একটি অ্যাকাউন্ট থাকতে হবে লগইন করতে, যারা অ্যাকাউন্ট নেই তাদের জন্য অবিলম্বে নিজেকে অনুষ্ঠান সারণীতে অনুমোদন দিন অফিসিয়াল বাজি লাইভ বাংলাদেশ ওয়েবসাইট পৃষ্ঠায় এবং সমস্ত নিবন্ধন প্রক্রিয়াগুলি অনুসরণ করুন।

কীভাবে বাজি লাইভে লগইন করবেন এবং সাইন আপ বোনাস দাবি করবেন?

আপনি আপনার বাজি লাইভ বাংলাদেশের অ্যাকাউন্টে লগইন করতে পারেন প্রথমে অফিসিয়াল বাজি লাইভ ওয়েবসাইট পৃষ্ঠাতে যান তারপরে লগইন ক্লিক করুন এবং আপনার ব্যবহারকারী নাম এবং পাসওয়ার্ড লিখুন।